Child care is undeniably a cornerstone of a thriving society and economy in Kentucky. However, the escalating costs, reaching as high as $11,000 annually, place immense strain on families across the state. For many, especially those with limited incomes, quality child care remains financially out of reach. This is where the Child Care Assistance Program (CCAP) steps in as a crucial lifeline. This program is designed to help eligible Kentucky families manage child care expenses, ensuring that parents can work or attend school while their children receive safe and nurturing care.

Despite its vital role, CCAP is underutilized, often due to a lack of awareness and the perceived complexity of the application process. Many eligible families miss out on this essential support. To bridge this gap, this article aims to provide a comprehensive guide to CCAP, answering key questions and clarifying the process from application to maintaining benefits. A crucial aspect for many seeking assistance is understanding who funds the Child Care Assistance Program in Kentucky. This article will delve into the funding sources, alongside a detailed exploration of eligibility, application procedures, and benefit management, ensuring families have the information they need to access this valuable resource.

For any further inquiries beyond this guide, please reach out through this form.

This resource will be regularly updated to reflect the most current information and program details.

Decoding CCAP Eligibility: Does Your Family Qualify?

What Exactly is the Child Care Assistance Program?

The Child Care Assistance Program (CCAP) in Kentucky is a state-administered initiative designed to provide financial aid to low-to-moderate income families. This assistance is specifically for child care costs, enabling parents or guardians who are working or actively pursuing employment, or furthering their education, to afford quality care for their children. By subsidizing child care, CCAP aims to support families’ economic self-sufficiency and promote the healthy development of young children in Kentucky.

Pinpointing the Eligibility Criteria for CCAP Benefits

To be deemed eligible for CCAP benefits in Kentucky, families must meet specific criteria. These qualifications are in place to ensure that assistance reaches those who need it most. The key requirements are:

-

Residency: The family must be residents of the state of Kentucky.

-

Child’s Age: The child requiring care must be under the age of 13. This age limit extends to 19 for children with documented special needs.

-

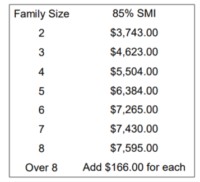

Income Level: The family’s gross household income must not exceed 85% of the State Median Income (SMI). This income threshold is adjusted based on family size to reflect varying needs.

-

Work or Education Requirement: Parents or guardians must be engaged in one of the following activities:

- Employment: Working an average of 20 hours per week for single parents or an average of 40 hours per week for two-parent households.

- Full-time Student: Enrollment in a certified trade school, college, or university as a full-time student.

- Job Training Programs: Participation in the K-TAP KentuckyWorks Program or the SNAP Employment and Training Program, which are designed to help individuals gain skills and find employment.

- Job Search: Actively seeking employment. CCAP provides a three-month job search period to support parents in finding work. DCC-90P Job Search Documentation form is required to initiate this.

-

Special Circumstances: Teen parents attending high school or GED programs and families involved with the Division of Protection and Permanency (P&P) may be eligible for CCAP regardless of their income level, recognizing the unique challenges they face.

To maintain ongoing eligibility for CCAP benefits, families must continue to meet the age, income, and work/education requirements. Regular recertification is required to ensure continued compliance.

Kentucky State Median Income Chart 2022 for CCAP Eligibility. Check official sources for the most updated figures.

CCAP Eligibility and Immigration Status: Clarifying Misconceptions

A common concern among families is whether immigration status affects CCAP eligibility. It’s important to clarify the rules:

- Child’s Citizenship: To receive CCAP benefits, the child must be a U.S. Citizen or a qualified immigrant. A qualified immigrant generally includes those with permanent resident status or asylum granted.

- Parent/Guardian’s Status: Crucially, adults in the household are not required to be U.S. citizens or qualified immigrants for their children to receive CCAP. The program focuses on supporting eligible children, regardless of their parents’ immigration status.

- Social Security Number: A Social Security Number is not mandatory for a child to apply for CCAP benefits, removing another potential barrier for some families.

Foster Care and Kinship Care: Navigating CCAP Eligibility

The eligibility rules differ slightly for children in foster care and kinship care arrangements:

- Foster Care: Children in formal foster care are not eligible for CCAP. However, child care assistance is available through other channels for foster families. Foster parents needing child care support should consult with their case worker to explore available options.

- Kinship Care: Kinship families, where children are cared for by relatives outside of formal foster care, may be eligible for CCAP if they independently meet the standard eligibility requirements, including income and work/education criteria.

Support for Homeless Families: Immediate CCAP Access

Recognizing the urgent needs of families experiencing homelessness, CCAP offers expedited access:

- Immediate Approval: Families who are experiencing homelessness, can provide a valid form of identification, and verbally confirm they meet the basic CCAP requirements are eligible for immediate CCAP approval.

- Acceptable Identification: Acceptable forms of ID include a driver’s license, student ID, military ID, or two alternative forms of verification.

- Documentation Period: While benefits begin immediately, homeless families have a three-month grace period from the application date to provide the Kentucky Department of Community Based Services (DCBS) with all standard required documentation for full approval.

- Consequences of Non-Documentation: If the necessary documentation is not provided within three months, the family will be deemed ineligible, and their CCAP case will be closed.

Applying for CCAP: A Step-by-Step Guide and Required Paperwork

Gathering Necessary Documents for Your CCAP Application

Applying for CCAP involves submitting specific documentation to the Kentucky Cabinet for Health and Family Services (CHFS). Having these documents prepared in advance can streamline the application process:

- Identification for Heads of Household:

- Driver’s License

- State-issued Photo ID

- Military ID

- Alternatively, two other forms of verification can be accepted.

- Birth Verification for Children Receiving Benefits:

- Birth Certificate

- Hospital birth record

- Proof of Residency and Household Composition: Documents confirming your Kentucky address and who resides in your household. Examples include:

- PAFS-76 Information Request Form

- Current lease agreement

- A written statement from someone who knows the family but does not live with them, verifying residency.

- Tax records

- Earned Income Documentation: Proof of income from employment. This may include:

- W2 forms

- Recent pay stubs

- A letter from your employer confirming your income

- Unearned Income Documentation: Verification of income sources other than employment, such as:

- Child support award letters

- Current award letters for other benefits

- Social Security Cards: While requested, providing Social Security cards is not mandatory for application processing.

- Proof of Educational Enrollment (if applicable): For parents applying based on full-time student status:

- School records or transcript

- Verification of enrollment from the educational institution

- Confirmation from the school’s admissions office (“CC” documentation)

- Proof of Citizenship, Immigration Status, or Refugee Status for Children Receiving Benefits:

- Important Note: Parents are not required to provide proof of their own citizenship or immigration status.

CCAP Application Processing Time: What to Expect

Once your application and all necessary documents are submitted, it’s natural to wonder about the processing timeline:

- Processing Timeframe: CCAP applications are generally processed within 30 days of submission.

- Notification of Status: CHFS will communicate the application status via mail or through the Kynect system, Kentucky’s integrated health and social services portal.

- Follow-up for Delays: If you have not received an update on your application status after 30 days, it’s advisable to contact DCBS directly at (502) 564-3440 to inquire about the delay.

Understanding the Job Search Period for CCAP

For families applying based on job search, it’s crucial to understand the specifics of this provision:

- Three-Month Window: The job search period is a three-month timeframe starting from the date of the initial CCAP application. During this period, families actively seeking employment can receive CCAP benefits.

- Ineligibility if Unsuccessful: If a family is unable to secure employment within this three-month period, they will be deemed ineligible for CCAP, and their case will be closed.

- One-Time Use per Year: The job search period can only be utilized once within a 12-month period at the initial application stage.

- Initiating Job Search: Applicants begin the job search period by completing the DCC-90P Job Search Documentation form, outlining their job search activities.

Job Search Period and Application Timing: Key Considerations

It’s important to note how initiating the job search period affects your application:

- Period is Considered “Used” Upon Initiation: Once the job search option is selected and initiated, it is considered used, regardless of whether employment is found immediately.

- Start Date: The start date for the three-month job search period is the date of the initial CCAP application. Applying and delaying program use doesn’t extend the job search window.

Household Composition and Incarceration: Determining Your Household Size

When determining household size for CCAP eligibility, the following rule applies:

- Incarcerated Individuals Excluded: Individuals who are currently incarcerated are not counted as part of the household for CCAP eligibility determinations.

Public Benefits and CCAP Eligibility: Can You Receive Both?

Many families rely on multiple forms of public assistance. It’s important to know how other benefits interact with CCAP:

- No Impact from Other Benefits: Receiving benefits from programs like SNAP (Supplemental Nutrition Assistance Program), SSI (Supplemental Security Income), K-TAP (Kentucky Transitional Assistance Program), and other programs administered by the Cabinet for Health and Family Services does not negatively impact your eligibility for CCAP benefits. These programs are designed to work in conjunction to support families’ overall well-being.

Disclosing a Child’s Disability Status (Special Needs) on the CCAP Application

Providing information about a child’s disability is crucial, as it can extend CCAP eligibility:

- Extended Age Eligibility: Children with special needs are eligible for CCAP until they reach the age of 19, recognizing the ongoing need for child care and support for these families.

- Acceptable Proof of Disability Status: To document a child’s disability status, families can provide various forms of verification:

- A formal diagnosis from a qualified healthcare professional, such as a pediatrician or mental health professional.

- A court order related to the child’s disability.

- An Individualized Education Program (IEP) provided by the child’s school.

- An award letter for Supplemental Security Income (SSI) benefits specifically for the child’s disability.

Shared Custody and CCAP Applications: How to Apply Separately

For parents sharing custody of a child and both needing child care assistance, the application process is as follows:

- Separate Applications Required: Parents who share custody must apply for CCAP assistance separately. Each parent needs to submit their own application to receive benefits.

- Specify Custody Schedule: When applying, each parent must clearly indicate the specific days the child is in their care to ensure accurate benefit allocation.

Receiving and Utilizing CCAP Benefits: What You Need to Know

Choosing a Child Care Provider and Using CCAP at Multiple Programs

Flexibility in child care arrangements is important for families. CCAP offers choices in provider selection:

- Approved Providers Only: CCAP subsidies can only be used at child care providers who are Licensed, Certified, or Registered with the Kentucky Division of Child Care (DCC). These providers must also agree to accept CCAP subsidy payments and be officially approved by the DCC. This ensures that CCAP funds are used for quality, regulated child care.

- Multiple Programs Allowed: CCAP benefits can be used at multiple child care programs if needed. This can be helpful for families with varied child care needs or schedules.

Finding a Child Care Center Accepting CCAP: Resources and Assistance

Locating a child care center that accepts CCAP is a key step after approval. Resources are available to assist families in this search. [The original article mentions resources are available but does not list them. This is an area for potential expansion and improvement in a more comprehensive guide. For example, listing the Kentucky Child Care Resource and Referral Network or the DCC provider search tool would be beneficial].

Understanding CCAP Copays: Family Contribution to Care Costs

While CCAP significantly reduces child care expenses, families may have a copayment responsibility:

- Copays Temporarily Waived: As of the last update of the original article, copays are currently waived for families due to federal COVID-19 pandemic relief funding.

- Resumption of Copays: It’s important to note that copays will resume once this federal funding is exhausted. The DCC will provide advance notice to families when copayments are reinstated.

- Estimating Copay Amounts: Families can get an estimate of their potential copay amount by referring to the Family CCAP Co-Payment Table. This table outlines copay amounts based on income and family size.

- Copay Waivers for P&P Cases: In cases where CCAP is received due to involvement with Protection and Permanency (P&P), copays may be waived, offering further financial relief.

CCAP Benefit Start Date: Backdating to Application Date

Understanding when CCAP benefits begin is crucial for financial planning:

- Eligibility Begins on Application Date: If approved, CCAP eligibility officially starts on the date of application, not just from the date of approval or contract receipt.

- Payment to Providers: Child care providers will receive payment from CCAP that covers the period from the application date to the date of approval, ensuring continuous coverage for eligible families.

Staying Informed About Your CCAP Case: Updates and Communication Channels

Keeping track of your CCAP case and any updates is essential for maintaining benefits:

- Kynect System Alerts: The Kynect system is the primary channel for communication. Families will receive alerts about updates and changes to their CCAP case through Kynect and are encouraged to check the system regularly to avoid missing important notifications.

- Mail Communication: Occasionally, DCBS may also send updates via postal mail. Families should regularly check their mail and ensure their address on file with DCBS is current and accurate to receive all communications.

Maintaining CCAP Benefits: Recertification and Change Reporting

Recertification: Annual Review of Continued Eligibility

Recertification is a standard process to ensure ongoing program integrity and appropriate benefit allocation:

- Purpose of Recertification: Recertification is the annual process by which CHFS re-evaluates a family’s continued eligibility for CCAP. This review considers any changes in work status, income, and other relevant factors.

Recertification Frequency: Yearly Renewal Requirement

CCAP benefits are not indefinite. Regular renewal is required to maintain assistance:

- Annual Recertification: Families are required to recertify for CCAP benefits on a yearly basis. This annual review ensures that families continue to meet eligibility criteria.

Recertification Process and Required Documentation

The recertification process is similar to the initial application in terms of documentation and verification:

- Recertification Methods: Families can initiate recertification by contacting DCBS by phone or visiting a local DCBS office to schedule a recertification interview.

- Documentation Requirements: The recertification process will require updated documentation to verify continued eligibility. This documentation is similar to what was required for the initial application and includes:

- Proof of Identification: Driver’s License, State Issued Photo ID, Military ID.

- Birth Verification: KVETS record, Birth Certificate, Hospital Birth Records.

- Earned Income: PAFS-700 form, Wage Stubs, Written Statements from employer.

- Self-Employment Income: Tax Returns (with Schedule C), Business Records, Work Logs, Written Statements.

- Unearned Income: Current Award Letters for any unearned income sources.

- Household Composition & Residency: PAFS-76 form, Current Lease (listing all residents), Written Statements verifying residency.

- Zero Income Documentation: PAFS-702 form, Written Statement if applicable.

Change Reporting: Your Responsibility to Update DCBS

Maintaining accurate information with DCBS is crucial for uninterrupted benefits and avoiding potential issues:

- Purpose of Change Reporting: Change reporting is the process of promptly informing DCBS about any changes in your circumstances that could affect your CCAP benefits.

- Reporting Timeframe: All changes must be reported to CHFS within 10 days of the change occurring. Prompt reporting is essential.

- Consequences of Failure to Report: Failure to report changes within 10 days can lead to potential loss of benefits or even accusations of fraud.

Types of Changes to Report to CHFS

It’s important to know what specific changes in circumstances require reporting to DCBS:

- Employment Changes:

- Starting or ending employment

- Changing employers

- Increase or decrease in work hours

- Increase or decrease in pay rate

- Household Changes:

- Increase or decrease in the number of household members (birth, moving in/out)

- Change in marital status

- Change in address or residence

- Self-Employment Changes:

- Changes in self-employment activities

- Child Care Needs Changes:

- Change in the scheduled hours child care is needed

- Changing child care providers

- Education/Training Changes:

- Beginning or ending full-time educational or training activities

- Public Benefit Program Changes:

- Beginning or ending participation in SNAP E&T or Kentucky Works activity

- Unearned Income Changes:

- Beginning or ending receipt of any type of unearned income

How to Report Changes to CHFS: Contacting DCBS

Reporting changes is a straightforward process:

- Reporting Methods: You can report changes to CHFS by contacting DCBS directly, either by phone or by visiting your local DCBS office in person. [Providing contact information for DCBS or a link to find local offices would be helpful here].

Appeals Process: Understanding Your Rights

Appealing a Notice of Suspected Intentional Program Violation

Families have the right to appeal certain decisions related to CCAP:

- Right to Appeal: If you receive a Notice of Suspected Intentional Program Violation, you have the right to appeal this notice.

- Appeal Deadline: To initiate an appeal, you must formally request a hearing within 30 days of the date of the notice.

Voluntary Waiver of Administrative Disqualification Hearing: Understanding Your Options

The notice may include a waiver document, and it’s important to understand its implications:

- Waiver is Optional: The Notice of Suspected Intentional Program Violation may include a Voluntary Waiver of Administrative Disqualification Hearing. Signing this waiver is not mandatory. It’s crucial to understand the implications before signing. Signing typically means you are forgoing your right to a hearing and accepting the program violation.

Navigating the Appeals Process: Administrative Hearings and Further Appeals

The appeals process involves several stages:

- Administrative Hearing: If you choose to appeal, an Administrative Hearing will be scheduled with an Administrative Hearing Officer.

- Hearing Timeline: This hearing will be held within 45 days of your hearing request.

- Appeal Withdrawal: You have the option to withdraw your appeal at any point during the process.

- Interpreter and Accommodations: You can request an interpreter or reasonable accommodations for the hearing if needed.

- Evidence Submission: At the hearing, both the agency (CHFS/DCBS) and your family will have the opportunity to present evidence to support their respective cases.

- Hearing Officer’s Recommended Order: After the hearing, the Hearing Officer will issue a Recommended Order. This order will either affirm or deny the agency’s decision regarding the Intentional Program Violation (IPV). The order includes Findings of Fact & Conclusions of Law and is submitted to the CHFS Secretary (Secretary Eric Friedlander).

- Appeal to CHFS Secretary: If you disagree with the Hearing Officer’s determination, you have 15 days to appeal the decision to the CHFS Secretary. The Secretary will review all case information and issue a Final Order, either affirming or denying the Hearing Officer’s recommendation.

- Appeal to Circuit Court: If you are still dissatisfied with the Secretary’s Final Order, you have up to 30 days to appeal the case to the Circuit Court.

- Legal Representation: Note: You will not be automatically provided with a lawyer for this process. However, your local Legal Aid organization may be able to offer assistance with your case.

Overpayments and Repayment Obligations

Even in appeals cases, overpayments may need to be repaid:

- Repayment Obligation: Yes, families are generally required to pay back any overpayments of CCAP benefits, even if you win your appeal or if the overpayment was determined to be due to an agency error.

- Installment Payment Requests: You can request to repay overpayments through installment payments to make repayment more manageable.

Consequences of Failing to Repay Overpayments

Failure to repay overpayments can lead to collection actions:

- Collection Actions: If you fail to make an initial payment or are more than sixty days late on a payment, CHFS may pursue various collection methods:

- Court-ordered repayment

- Offsetting your state tax refund

- Wage garnishment

- Garnishment of lottery winnings

- Referral to a collection agency

Intentional Program Violation (IPV) Charges and Impact on Future Benefits

Being charged with an IPV has significant consequences for future CCAP eligibility:

- First IPV Charge: Disqualification from CCAP for 12 months.

- Second IPV Charge: Disqualification from CCAP for 24 months.

- Third IPV Charge: Permanent disqualification from CCAP, unless a judge determines a different disqualification period.

Reapplying for CCAP After an IPV Disqualification

Disqualification is not always permanent, and reapplication is possible:

- Reapplication Allowed After Disqualification: Yes, you can reapply for CCAP again once your disqualification period has ended. After the disqualification period, you will need to go through the standard application process again to determine eligibility.

Who Funds the Child Care Assistance Program in Kentucky?

Understanding the funding sources behind CCAP is essential to appreciating its scope and sustainability. The Kentucky Child Care Assistance Program is primarily funded through a combination of federal and state resources.

- Federal Funding: A significant portion of CCAP funding comes from the federal government through the Child Care and Development Fund (CCDF). The CCDF is a block grant that provides federal funding to states, territories, and tribes to support low-income families in accessing affordable, quality child care. This federal funding is intended to increase the availability, affordability, and quality of child care, and to support parents in working or attending training and education.

- State Funding: In addition to federal CCDF funds, the Kentucky state government also contributes state general funds to support the CCAP. The state allocation demonstrates Kentucky’s commitment to early childhood education and supporting working families. The specific amount of state funding can vary from year to year based on state budget appropriations.

- Combined Funding Model: The CCAP operates as a combined federal-state funded program. This partnership allows for a more robust and sustainable funding base to serve eligible families across Kentucky. The blending of funds enables the program to reach a larger number of children and families than either funding source could achieve independently.

The allocation and management of these funds are overseen by the Kentucky Cabinet for Health and Family Services (CHFS), specifically the Department for Community Based Services (DCBS) and the Division of Child Care (DCC). These agencies are responsible for ensuring that the funds are used effectively and efficiently to support eligible families and maintain program integrity.

By understanding the funding structure, families and stakeholders can appreciate the collaborative effort to make child care assistance available in Kentucky and advocate for continued support and improvement of the program.

Disclaimer: This information is for informational purposes only and should not be considered legal advice. For specific legal guidance regarding the Child Care Assistance Program, please consult with the Kentucky Department for Community Based Services or a legal aid organization.