The automotive sector is undergoing a significant transformation. From manufacturers to dealerships, and even financing arms, businesses are recognizing the need to innovate and adapt to maintain a competitive edge and ensure long-term success. In this evolving landscape, customer loyalty programs are emerging as a powerful strategy, especially for car finance companies looking to secure their future. While often associated with dealerships or manufacturers, loyalty programs offer unique advantages for finance companies, enabling them to foster stronger customer relationships, improve data collection, and ultimately, drive profitability.

For detailed statistics and insights into the future trends of customer loyalty in the automotive industry, we recommend downloading our comprehensive Global Customer Loyalty Report.

Key Insights at a Glance:

- Loyalty programs are becoming increasingly crucial for car finance companies to address industry-specific challenges.

- Connected car data and digital platforms provide innovative opportunities for finance loyalty rewards.

- Strategic partnerships and B2B programs can enhance the value proposition of finance loyalty initiatives.

- Incentivizing data sharing through loyalty programs is key for personalized financial services.

- Explore inspiring examples of automotive loyalty programs to adapt for the finance sector.

Understanding Automotive Loyalty Programs in the Finance Context

Automotive loyalty programs are customer retention strategies tailored for the automotive industry. While traditionally implemented by car manufacturers and dealerships, these programs are equally, if not more, relevant for car finance companies. These programs, whether they are car manufacturer loyalty programs, dealership reward programs, or specifically, car finance loyalty programs, share a common goal: to increase customer lifetime value. For finance companies, this translates to encouraging repeat financing, building long-term relationships beyond a single loan, and creating a loyal customer base that chooses their financial services again and again.

Different types of automotive loyalty programs can be adapted to meet the specific Key Performance Indicators (KPIs) of a car finance company. These might include enhancing customer personalization in financial offerings, boosting brand recognition and trust in financial services, and increasing engagement across digital platforms.

“As connected car technology becomes more integrated with financial services, the opportunities for car finance loyalty programs will expand. Imagine a loyalty program that rewards customers for consistent on-time payments or for utilizing connected car data to get personalized insurance rates or better financing terms. This is the future of automotive finance loyalty.”

Expert Automotive Finance Analyst, [Source – Hypothetical Expert Quote]

Here are examples of how car finance loyalty programs can be structured:

- Commitment-Based Finance Loyalty Program: Customers receive preferential financing rates or terms in exchange for committing to use the finance company for their next vehicle purchase or for utilizing specific financial products like insurance or extended warranties. This could also involve data sharing from connected car platforms to personalize financial offerings.

- Membership-Based Finance Loyalty Program: Customers gain access to exclusive content, such as financial planning webinars, personalized finance tips, priority customer service, and exclusive offers on refinancing or lease extensions by becoming members. This program focuses on building a community and positioning the finance company as a trusted financial partner.

- B2B Loyalty Program for Dealership Partners: Finance companies can offer special incentives and rewards to dealerships that consistently channel customers towards their financing options. This strengthens partnerships and ensures a steady stream of loan originations.

- Loyalty Program Integrated with Auxiliary Services: A coalition program could involve partnerships with insurance providers, roadside assistance services, or even fuel providers, allowing customers to earn rewards on loan payments and redeem them for benefits across these partner services.

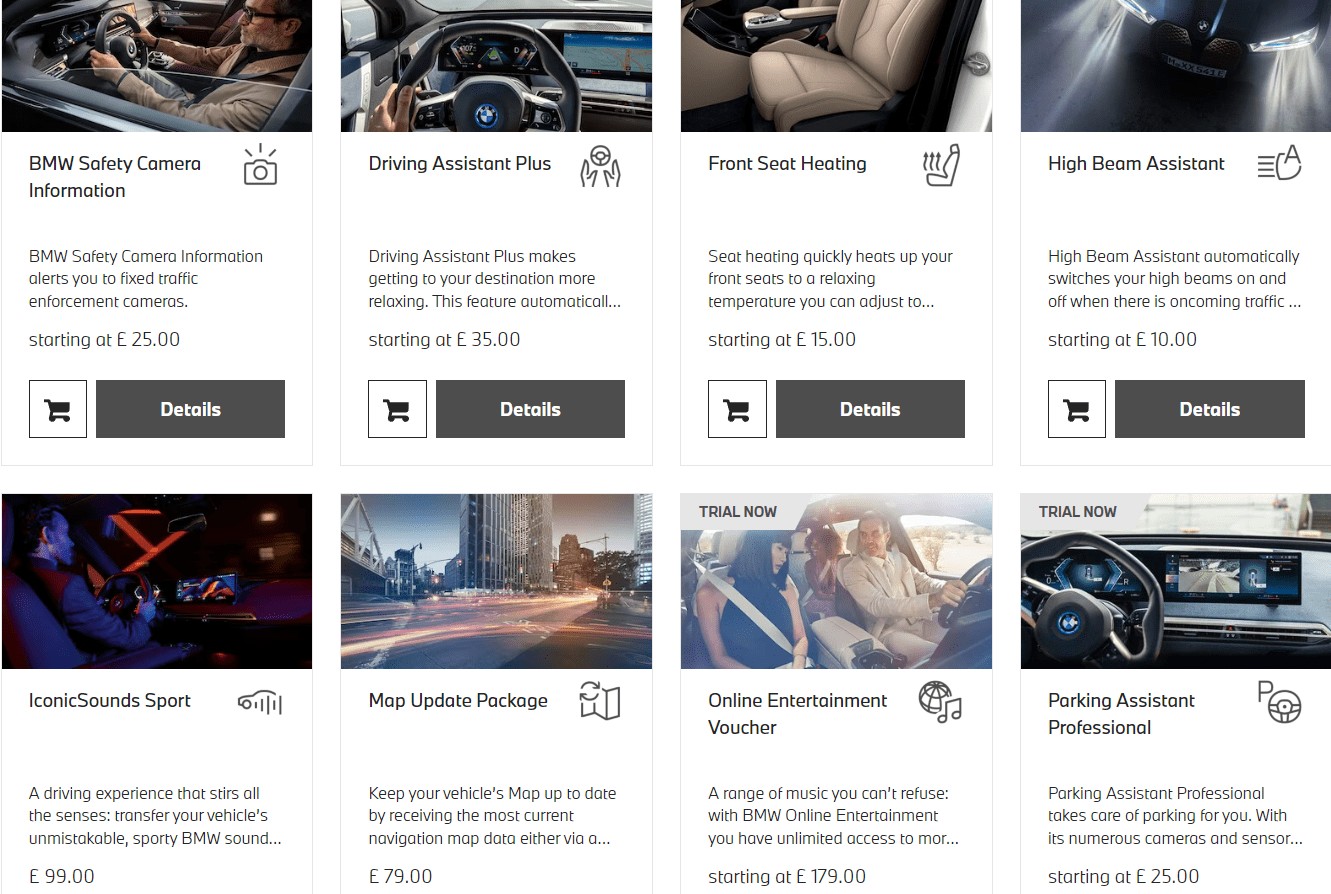

Connected car features, similar to BMW Digital Connect, can be integrated as rewards in car finance loyalty programs, offering benefits like personalized insurance rates based on driving data or convenient payment reminders through in-car systems.

Key Customer Retention Challenges for Car Finance Companies

To design effective loyalty programs, car finance companies must understand the specific challenges they face in customer retention. While the automotive industry as a whole deals with infrequent purchase cycles, finance companies encounter unique hurdles:

- Transactional Customer Relationships: The relationship between a finance company and a customer is often perceived as purely transactional, focused solely on the loan term. Building emotional loyalty beyond this transaction is crucial.

- Limited Touchpoints Post-Loan Origination: Once a loan is approved, interaction with customers often decreases, primarily limited to payment reminders. This lack of consistent engagement hinders the development of lasting relationships.

- Data Silos and Personalization Challenges: Finance companies may lack comprehensive data beyond credit scores and loan applications, making it difficult to personalize financial services and offers to individual customer needs and preferences.

Looking for innovative ways to enhance customer data collection in finance? Explore our Loyalty Innovation resources for cutting-edge strategies!

Due to the significant financial commitment involved in vehicle financing, car finance companies have a limited window to engage customers meaningfully. This makes it challenging to gather valuable data on customer financial goals, vehicle preferences for future purchases, and overall satisfaction with the financing experience. Consequently, personalization, a key driver of loyalty, becomes a significant challenge. Furthermore, the infrequent nature of financing needs makes it difficult to consistently educate customers about new financial products and cultivate brand loyalty over time.

However, the rise of digital banking and connected car technology offers new opportunities. Finance companies can leverage digital platforms to maintain consistent communication, offer personalized financial advice, and integrate loyalty rewards directly into digital banking interfaces or even connected car dashboards. This enhanced connectivity enables more frequent engagement and provides avenues to incentivize desired customer behaviors, such as on-time payments and proactive financial planning.

“Personalization is paramount in building loyalty in the car finance sector. Understanding a customer’s financial journey, their future vehicle aspirations, and tailoring financial solutions to their unique circumstances is the key to transforming a transactional relationship into a loyal partnership.”

Sarah Chen, Head of Customer Experience, [Leading Car Finance Company – Hypothetical]

Essential Loyalty Program Features for Car Finance Companies to Excel

Car finance loyalty programs are constructed from various components. To create a program that truly resonates with customers and drives loyalty, each element must be thoughtfully implemented and seamlessly integrated. Here are crucial features for finance companies aiming to launch a standout loyalty program:

Dedicated Member Portal & Mobile App Integration

Finance companies need a user-friendly digital “home” for their loyalty program. This could be a dedicated member portal accessible via web and mobile app, serving as the primary touchpoint for customers to interact with the rewards system. The portal should be visually appealing, easy to navigate, and clearly highlight the benefits of membership. It should showcase earned rewards, available offers, personalized financial insights, and provide a seamless experience for managing loyalty points and redeeming rewards. Integration with the finance company’s mobile banking app is essential for convenient access and engagement.

A well-designed membership page for a car finance loyalty program should clearly display progress towards rewards, personalized offers, and easy access to financial account information and loyalty benefits.

Flexible and Relevant Reward Engine

The “loyalty engine” refers to the core mechanics of the program. For finance companies, this could involve point-based systems where customers earn points for on-time payments, referrals, enrolling in autopay, or utilizing other financial products. These points can be redeemed for various rewards, such as discounts on loan interest, reduced fees, cashback, or gift cards.

Alternatively, a perks-based system could offer unconditional benefits to all members, such as access to financial wellness resources, credit score monitoring, or priority customer service. The choice depends on the finance company’s objectives – points systems incentivize specific behaviors, while perks programs focus on building a sense of value and community. Hybrid models combining both approaches can also be effective.

Strategic Coalition Programs

Coalition loyalty programs, bringing together multiple brands, can significantly enhance the value proposition. For car finance companies, this could involve partnerships with dealerships, insurance companies, auto repair shops, and even lifestyle brands. Customers could earn rewards through loan payments and redeem them for discounts on car maintenance, insurance premiums, or even travel and entertainment experiences through partner brands. This expands the appeal of the loyalty program beyond purely financial rewards.

Coalition programs significantly amplify the value of a car finance loyalty program membership, providing a competitive advantage by offering diverse rewards and benefits.

Subscription-Based Premium Tiers

While most loyalty programs are free, a subscription model can be successful if the value proposition is strong. Car finance companies could offer premium loyalty tiers with a recurring subscription fee that unlocks exclusive, high-value benefits. These could include lower interest rates on future loans, enhanced financial planning services, premium roadside assistance, or even access to exclusive financial products. The key is to offer benefits that are highly desirable and justify the subscription fee.

Partner Rewards and Lifestyle Integrations

One of the most compelling aspects of a car finance loyalty program is the potential for partner rewards. Finance companies can collaborate with businesses in related sectors (insurance, auto services) and even lifestyle categories (retail, travel, dining) to offer a diverse catalog of rewards. Customers could redeem points for discounts at partner stores, travel vouchers, dining experiences, or merchandise. This adds lifestyle value and broadens the appeal of the program.

Partner rewards are a key trend in modern loyalty programs, as highlighted in our Global Customer Loyalty Report 2025. Download it to discover more about leveraging partnerships for loyalty program success.

Gamified Data Collection and Personalized Offers

A major challenge for finance companies is limited customer data for personalization. Loyalty programs can be leveraged to incentivize data collection through gamified surveys and interactive profiles. Finance companies can create engaging quizzes or polls about customers’ financial goals, vehicle preferences, risk tolerance, and lifestyle choices, rewarding participation with loyalty points or bonus perks. This data can be used to create detailed customer profiles and deliver highly personalized financial offers, advice, and communication.

Gamified data collection within a loyalty program unlocks a new level of customer insights, enabling car finance companies to offer truly personalized financial solutions.

Connected Car Technology Integration for Rewards and Engagement

The increasing prevalence of connected cars presents exciting opportunities for finance loyalty programs. Finance companies can integrate with connected car platforms to offer rewards based on driving behavior, vehicle maintenance, or even payment patterns. For example, customers could earn bonus points for safe driving habits (tracked via connected car data), timely vehicle maintenance (verified through connected car diagnostics), or consistent on-time loan payments. Connected car data can also be used to personalize insurance rates and offer proactive financial advice based on vehicle usage and driving patterns.

Mobile-First Engagement and Digital Loyalty Cards

A dedicated mobile app is crucial for a modern loyalty program. Beyond the member portal, a mobile app can serve as a central engagement hub, increasing touchpoints and facilitating seamless interaction. The app can send push notifications about new offers, payment reminders, loyalty point updates, and personalized financial tips. Integrating a digital loyalty card within the mobile app and mobile wallets provides convenient access to loyalty benefits and streamlines in-person interactions (e.g., at dealerships or partner locations).

Watch our video on how Mobile Wallet integration can strengthen customer relationships for finance companies.

Inspiring Examples of Automotive Loyalty Program Concepts Adaptable for Finance

While the provided examples focus on broader automotive loyalty programs, we can draw inspiration and adapt key elements for car finance companies:

(Adaptations of the original examples to fit finance context would be added here, focusing on how each program’s mechanics could be applied to finance loyalty. For example, how Enterprise Plus’ tiered system could be adapted for loan tiers based on credit score or loan amount, or how FordPass’ app-based engagement could be mirrored in a finance app with loan management tools and loyalty rewards.)

(Instead of re-listing all 8 examples in detail, I will provide a few conceptual adaptations, focusing on the principles and features relevant to finance.)

1. Enterprise Plus (Rental Car Loyalty Adaptation):

- Finance Adaptation: Tiered loan programs based on customer creditworthiness and loan history. Higher tiers could offer lower interest rates, waived fees, or faster loan processing for repeat customers or customers with excellent credit. Points could be earned for on-time payments and redeemed for interest rate reductions on future loans or cashback.

2. FordPass (Manufacturer App Loyalty Adaptation):

- Finance Adaptation: A dedicated finance mobile app integrated with loyalty features. The app could offer loan management tools, payment reminders, financial wellness resources, and access to loyalty rewards. Partnerships with insurance companies could offer bundled discounts or loyalty points for purchasing insurance through the finance company.

3. BMW Inside Edge (Perks-Based Program Adaptation):

- Finance Adaptation: A perks-based finance loyalty program offering instant benefits like free credit score monitoring, access to financial planning webinars, or discounts on financial products. Prize draws could offer larger financial rewards like debt reduction or contributions to savings accounts.

4. Volvo Cars Loyalty Program (Age-Based Rewards Adaptation):

- Finance Adaptation: Loyalty rewards based on the duration of the customer relationship. Longer-term customers could receive benefits like preferential refinancing rates, loyalty bonuses upon loan completion, or early access to new financial products.

5. Europcar Privilege (Hybrid Tiered & Perk Program Adaptation):

- Finance Adaptation: A hybrid finance loyalty program with baseline perks for all members (e.g., financial tips, basic credit monitoring) combined with tiered benefits for higher engagement (e.g., lower rates, premium service). Early enrollment perks could encourage immediate sign-ups.

6. Nissan One to One Rewards (Earn & Burn Adaptation):

- Finance Adaptation: A straightforward points-based system where points are earned for loan payments, referrals, or utilizing additional financial services. Points can be redeemed for cashback, statement credits, or discounts on future financing. Physical loyalty cards (digital within the app) could enhance perceived exclusivity.

7. Fred Beans AutoRewards (Dealership Loyalty Adaptation):

- Finance Adaptation: Focus on direct financial rewards like interest rate discounts and fee waivers. Milestone rewards could be unlocked for consistent on-time payments or reaching specific loan milestones. Points could be earned for non-transactional engagement like completing financial surveys or using the finance company’s app.

8. Subaru Ownership Benefits (Benefits Pool Adaptation):

- Finance Adaptation: A pool of financial benefits available to finance customers, such as discounts on financial planning services, insurance products, or access to exclusive financial tools. The benefits could be updated periodically to maintain engagement and encourage repeat customer interactions.

Accelerating Towards Customer Loyalty in Car Finance

Loyalty programs present a significant opportunity for car finance companies to cultivate stronger customer relationships, enhance data-driven personalization, and drive long-term profitability in a competitive market. By strategically implementing these programs, finance companies can move beyond transactional interactions and build lasting loyalty that secures their success in the evolving automotive finance landscape.

We are ready to discuss sophisticated loyalty solutions and API integrations to help your finance company design and implement a powerful customer loyalty program. Feel free to send us your RFP to explore how we can partner in your loyalty journey.

And don’t forget to download Antavo’s Global Customer Loyalty Report for in-depth data and future-focused insights to guide your next-generation loyalty strategies.

Sheila Power

Sheila is Antavo’s VP of UK & North America. She has decades-long experience working with consultancies and SaaS technology providers globally. A passionate advocate for loyalty programs, she is eager to advise brands on optimal loyalty solutions.