Employee wellness programs are increasingly recognized as a strategic initiative for organizations aiming to manage and reduce escalating health care costs. The fundamental principle behind these programs is the proactive promotion of employee health, with the expectation that healthier employees will lead to lower health care expenditures. Mounting scientific evidence supports this premise, demonstrating a clear link between corporate wellness programs, improved employee health, reduced health risks, and ultimately, decreased health care costs.

Epidemiological studies, utilizing large population databases, have been instrumental in establishing this connection. These studies analyze the relationship between health behaviors and their subsequent impact on health care spending. The consistent finding across this body of research is that unhealthy behaviors and elevated health risks are directly correlated with higher health care costs. While these studies, similar to early research on the dangers of smoking, are not randomized clinical trials, the compelling evidence they provide underscores the significant role of lifestyle choices in driving health care expenses.

A substantial portion of health care costs can be attributed to modifiable lifestyle factors. Understanding this link is crucial to appreciating how wellness initiatives can effectively influence health care expenditures.

4 Key Strategies to Maximize the Impact of Employee Wellness Programs on Health Care Costs

For employers in the United States, healthcare coverage represents a major employee-related expense. It’s a well-established fact that healthy behaviors contribute to controlling these costs, while unhealthy behaviors lead to increased expenditures. Consider the financial burden associated with smoking: it adds an average of $2,056 per individual annually in health expenses. Similarly, a sedentary lifestyle incurs an additional $1,313 per person each year. These costs are largely preventable, highlighting the potential for wellness programs to reduce health insurance costs for businesses of all sizes.

To address the challenge of rising health insurance costs, many organizations, both large and small, are turning to wellness health insurance vendors. These vendors offer programs designed to incentivize and encourage employees to adopt healthier lifestyles.

WellSteps utilizes technology and proven strategies to help clients reduce healthcare costs. Here are 4 key approaches:

- Comprehensive Online Program Center: Providing employees with easy access to wellness resources, information, and program details.

- Rewards Activity and Incentive Tracking Tool: Motivating participation and engagement by tracking healthy activities and administering rewards effectively.

- Targeted Behavior Change Campaigns: Implementing focused campaigns designed to promote specific healthy behaviors and address key risk factors within the employee population.

- Personalized Health Behavior Tracking (My Tracker): Empowering employees to monitor their health behaviors using a user-friendly tool that integrates with popular wearable devices, fostering self-awareness and accountability.

This represents just a snapshot of the tools and methods employed to empower organizations to cultivate healthier workplaces.

It’s important to acknowledge that not all health conditions are solely determined by lifestyle choices. Diabetes, for instance, while significantly impacted by lifestyle, can also have a hereditary component. The annual cost associated with diabetes is substantial, averaging $2,151 per individual. While wellness programs can play a crucial role in managing Type II diabetes and mitigating its impact, they may not completely eliminate the condition or its associated costs, particularly in cases with strong genetic predispositions.

Recognizing these nuances is essential for setting realistic expectations regarding the extent to which wellness programs can reduce health care costs. While significant savings are achievable by addressing modifiable behaviors, it’s important to understand the limitations when dealing with conditions that have complex or non-behavioral origins.

The Compelling Rationale for Controlling Rising Health Care Costs

The question isn’t really why should rising health care costs be controlled, but rather why not? Reducing employee health care costs through effective wellness strategies is a mutually beneficial outcome. It’s not simply about cutting expenses; it’s about genuinely improving the lives and well-being of employees. This approach is not about being frugal at the expense of employees, but rather a strategic move that benefits both the company and its workforce.

Furthermore, fostering a wellness culture in the workplace has positive ripple effects beyond just cost savings. It directly contributes to increased employee happiness and well-being, both within and outside of work hours. Happier employees are more productive and engaged at work. Outside of work, improved health translates to better mental health, increased life satisfaction, and a higher overall quality of life.

Tangible Benefits of Reducing Healthcare Costs

We’ve already touched upon some of the advantages of controlling health care costs, but let’s delve into a more comprehensive list of benefits. There is virtually no downside to actively working to reduce health insurance costs through wellness initiatives. The misconception that cost reduction inevitably leads to diminished employee benefits is simply untrue. The goal is not to strip away benefits, but to enhance overall employee health – a truly worthwhile objective and one of the most effective strategies to reduce healthcare costs. Wellness health insurance providers understand how to implement programs and incentives that create a win-win scenario, benefiting both employees and the organization.

Here are key benefits that arise from strategies aimed at making healthcare more affordable:

- Improved Employee Health Behaviors: Wellness programs encourage and support employees in adopting healthier habits.

- Reduced Elevated Health Risks: Proactive health management leads to a decrease in preventable health risks like high blood pressure, high cholesterol, and obesity.

- Lower Health Care Costs: The direct result of a healthier workforce is a reduction in medical claims and overall health care expenditures.

- Increased Productivity: Healthy and happy employees are more engaged, energetic, and productive in their roles.

- Improved Employee Morale: Investing in employee well-being demonstrates care and value, boosting morale and fostering a positive work environment.

The Evidence is Clear: Healthy Behaviors Directly Reduce Healthcare Costs

In 2016, the Centers for Disease Control and Prevention (CDC) published a significant paper demonstrating the clear connection between insufficient physical activity and increased employee health care costs. This study is just one example among many that reinforce this critical link. To fully grasp the strength of this evidence, let’s examine the methodology of the CDC research.

CDC researchers combined data from the National Health Interview Survey (NHIS) spanning 2001-2010 with data from the Medical Expenditure Panel Survey (MEPS). The NHIS gathers comprehensive health information from individuals across the United States through face-to-face interviews. MEPS collects detailed health care cost data from both federal agencies and private insurance providers. The merged dataset encompassed information from over 58,000 individuals, providing a robust sample size for analysis.

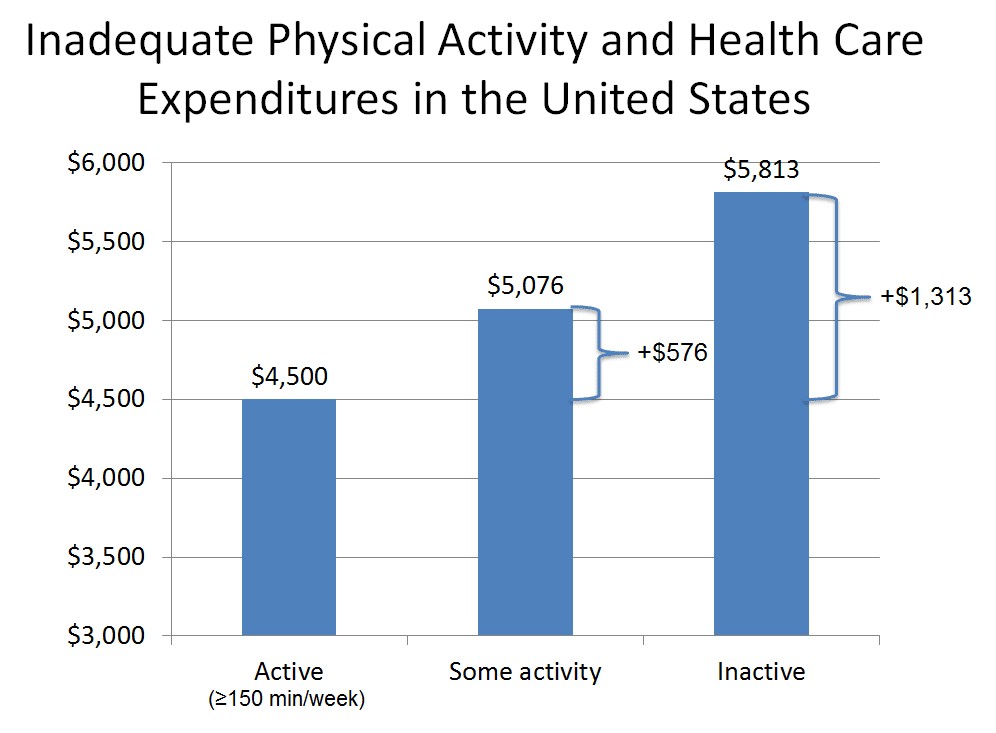

Researchers then analyzed the differences in health care costs across varying levels of physical activity. The findings were compelling: individuals engaging in more than 150 minutes of exercise per week incurred approximately $4,500 per year in health care costs. Those exercising between zero and 150 minutes weekly spent $5,076 annually, while individuals who were completely inactive faced the highest costs, averaging $5,813 per year.

Understanding the Financial Impact: Employee Wellness Programs and Health Care Costs

This data clearly illustrates the cost differential associated with physical activity levels. Compared to active individuals, sedentary adults spend an average of $1,313 more on health care each year.

Critics might argue that correlation does not equal causation, suggesting that pre-existing high health care costs could be the cause of sedentary behavior, rather than the other way around. However, the CDC researchers rigorously controlled for various confounding factors, including age, sex, body mass index, socioeconomic status, and other relevant variables.

Crucially, the study design further strengthened the causal link by collecting physical activity data at year one and then tracking health care claims data two years later. This temporal separation helps to establish that physical inactivity preceded and likely contributed to the higher health care costs observed in subsequent years.

The Business Imperative: Why Active and Healthy Employees Matter

This CDC study, along with numerous others, consistently demonstrates that lower levels of physical activity are directly associated with higher health care costs. But the implications extend beyond individual health – they have significant financial ramifications for businesses.

The CDC study further revealed that a staggering 11.1% of total health care expenditures in the United States are directly attributable to insufficient physical activity.

Let’s put this into perspective: With the United States spending approximately $3 trillion on health care annually, physical inactivity accounts for a massive $333 billion in health care costs ($3 trillion x 11.1%).

Extrapolating from other epidemiological studies focusing on different unhealthy behaviors (referenced below), we can calculate the broader financial impact of lifestyle choices on health care spending. Extensive research has meticulously quantified the health care costs associated with smoking, hypertension, obesity, and diabetes. Each of these unhealthy behaviors is consistently linked to significantly elevated health care expenditures.

Synthesizing data from these various studies, we can visualize the proportion of total health care expenditure attributable to each of these key unhealthy behaviors.

Identifying the Major Drivers of Rising Insurance Costs

Diabetes alone accounts for approximately 20% of total health care costs. When considering substance abuse, stress, accidents, and poor nutrition in addition to these factors, unhealthy lifestyle behaviors explain nearly 70% of our overall health care spending.

It’s important to note that this analysis doesn’t fully capture the significant overlap between these different health risks. For example, individuals with diabetes are also more likely to be physically inactive and may also suffer from hypertension.

While the precise extent of this overlap is difficult to quantify, the overarching conclusion remains clear: a substantial majority of health care expenses are linked to preventable conditions.

This means that of the $3 trillion spent on health care, a significant 70% is potentially driven by individuals’ lifestyle choices – encompassing poor dietary habits, lack of physical activity, tobacco use, and other unhealthy behaviors.

This is, in fact, encouraging news. It suggests that we have a degree of control over these enormous expenses. If lifestyle choices are indeed the primary driver of health care costs in the United States, then interventions aimed at helping people adopt and maintain healthy behaviors can have a direct and substantial impact on reducing national health care expenditures.

The Annual Financial Burden of Unhealthy Behaviors

The following chart effectively summarizes the individual cost implications of unhealthy behaviors. Comparing smokers to non-smokers reveals a health care cost difference of approximately $2,056 per person per year. The gap between physically active and inactive individuals is about $1,313 annually.

Hypertension adds an estimated $733 per year in health care costs, while obesity contributes an additional $2,085 compared to individuals at a healthy weight. Diabetes carries the highest individual cost burden, adding approximately $2,151 per year relative to those without diabetes.

These correlations are exceptionally well-documented and supported by extensive research. For those seeking deeper validation, a comprehensive list of references used to generate these figures is available at the end of this article.

The prestigious New England Journal of Medicine reported compelling data demonstrating that for every 1% reduction in total cholesterol, the risk of heart attack decreases by 2 to 3%. Similarly, for every one-point decrease in elevated diastolic blood pressure, heart disease risk declines by another 2 to 3%.

These findings underscore a clear pathway: by promoting behavior change, we can effectively reduce elevated health risks, lower the likelihood of developing chronic diseases, and, consequently, reduce health care costs within our expensive health care system. The relationship can be summarized as follows:

Behavior Change → Reduced Health Risks → Lower Chronic Disease Rates → Reduced Healthcare Costs

How Businesses Can Leverage Employee Wellness Programs to Control Health Care Costs

The most effective strategies for reducing health care costs are those that drive real, sustainable changes in employee health behaviors. Focusing on employee wellness and actively encouraging behavior modification is paramount. However, behavior change is often challenging, which is why partnering with a wellness vendor specializing in this area is crucial for achieving optimal program success.

Here are key approaches to reduce health insurance cost through a strategic partnership with WellSteps:

Business health insurance costs don’t have to be a constant drain on resources. There are proven, effective ways to manage these expenses. Contact us today to learn more about how WellSteps can help your organization implement a successful wellness program and achieve tangible cost savings.

Wellness Programs as a Cost-Saving Insurance Strategy

The data presented underscores the fundamental principle for successful wellness programs: it all begins with behaviors. Unhealthy behaviors and health care costs are inextricably linked. Comprehensive wellness programs that are grounded in effective behavior change strategies are essential for improving employee health behaviors, reducing elevated health risks, and ultimately, lowering health care costs.

Furthermore, successful programs should empower employees to maintain these healthy behaviors throughout their lives, creating long-term positive impact. This is a significant undertaking, and realistically, many wellness programs may fall short of achieving these comprehensive results.

This reality explains why some critics argue that wellness programs are ineffective at reducing health care costs. And in many cases, these criticisms may be valid. Helping individuals change ingrained behaviors is one of the most challenging endeavors in human health.

The Power of Lifestyle: Impacting Wellness Through Employee Habits

For a wellness program to exert any meaningful influence on health care costs, it must be demonstrably successful in helping individuals adopt and, more importantly, maintain healthy behaviors over the long term. For deeper insights into effective program design, we encourage you to explore our articles on “How to Design Wellness Programs that are Successful” and “How to Develop a Health-Contingent Wellness Program.”

Real-World Success: Wellness Programs in Action

Here’s a compelling example of how one organization successfully implemented these principles to achieve significant health care cost reductions. The Boise School District, with 3500 employees, partnered with WellSteps and actively participated in our comprehensive solution. Because the program prioritized behavior change, employees were empowered to adopt and sustain healthier lifestyles.

The results were remarkable: employee health risks improved measurably, and substantial reductions in health care costs were realized. Critically, these program outcomes were rigorously documented and published in peer-reviewed medical journals, providing robust validation of the program’s effectiveness.

Building upon the epidemiological evidence highlighting the strong link between poor health behaviors and elevated health care costs, this real-world example provides further compelling proof: wellness programs that effectively change employee behavior can indeed reduce health care costs.

Final Thoughts: Maximizing the Impact of Employee Wellness Programs on Health Care Costs

Corporate wellness programs designed to control health care costs and spending must maintain a laser focus on the root problem: unhealthy employee behaviors. This behavior-centric approach is the only viable path for corporate wellness initiatives to effectively reduce health care expenditures and create a healthier, more productive workforce. Choosing the right approach is paramount for program success.

FAQs

Why Are We Struggling to Control Healthcare Costs?

It’s not necessarily that we can’t control healthcare costs, but rather that previous approaches have often been misguided. Historically, cost-cutting measures have sometimes focused on simply reducing benefits or shifting costs onto employees, which can be detrimental to morale and employee well-being. Fortunately, the focus is shifting. Wellness insurance providers like WellSteps offer a more effective paradigm: improving employee health as the primary driver for reducing health care costs, creating a win-win scenario.

What Are the Advantages of Cost-Sharing in Health Care?

The primary advantage of cost-sharing mechanisms, such as deductibles and co-pays, is increased awareness. When employees are more directly aware of the costs associated with their health care plan, they tend to be more mindful of health care spending decisions.

How Much Does Employee Health Insurance Cost Businesses?

According to the 2020 Kaiser Family Foundation Report, in 2020, small firms with fewer than 200 employees paid approximately $14,000 annually for family coverage and $8,000 for single coverage. These figures highlight the significant financial investment businesses make in employee health benefits.

Effective Strategies to Reduce Health Insurance Costs

The most effective strategy for reducing health insurance costs is to proactively improve the health of your employee population. This can be effectively achieved through partnerships with wellness vendors specializing in behavior change, utilizing incentives, rewards programs, and health behavior tracking software. When considering how to control health care costs, simply cutting benefits is a counterproductive approach. Focusing on wellness is the sustainable solution.

Are Wellness Programs Insurance the Best Way to Reduce Healthcare Costs?

Yes, investing in employee wellness programs is arguably the most strategic and beneficial way to reduce healthcare costs in the long run. The alternative – simply cutting business health insurance costs – can have severe negative consequences for employee morale and a company’s reputation, making it an undesirable option for most organizations. In contrast, prioritizing employee health through wellness initiatives not only reduces costs but also boosts productivity, enhances employee morale, and strengthens the company’s image as an employer of choice, attracting and retaining top talent.

[maxbutton id=”1″]

REFERENCES

Health, Life Expectancy, and Health Care Spending among the Elderlyhttp://www.nejm.org/doi/pdf/10.1056/NEJMsa020614

Inadequate Physical Activity and Health Care Expenditures in the United Stateshttps://www.cdc.gov/nccdphp/dnpao/docs/carlson-physical-activity-and-healthcare-expenditures-final-508tagged.pdf

Higher Health Care Costs with Obesityhttps://www.hsph.harvard.edu/obesity-prevention-source/obesity-consequences/economic/

Medical Cost of Overweight and Obesityhttps://www.ncbi.nlm.nih.gov/pmc/articles/PMC2891924/

The Lifetime Cost of Diabetes and Its Implications for Diabetes Preventionhttp://care.diabetesjournals.org/content/37/9/2557

Hypertension and Health Care Costs:https://meps.ahrq.gov/data_files/publications/st404/stat404.shtml

Annual Healthcare Spending Attributable to Cigarette Smokinghttps://www.ncbi.nlm.nih.gov/pmc/articles/PMC4603661/

Estimating the Cost of a Smoking Employeehttp://tobaccocontrol.bmj.com/content/early/2013/05/25/tobaccocontrol-2012-050888