For businesses with employees on the move, managing vehicle expenses can be a significant undertaking. Company-owned fleets, once a common solution, are now often seen as costly and complex. Taxable car allowances, while simpler, can lead to wasted funds and tax burdens for both employers and employees. This is where car reimbursement programs come into play, offering a more efficient and often tax-advantaged approach. But what is a car reimbursement program, and how can it benefit your business and your mobile workforce?

This comprehensive guide will explore the world of car reimbursement programs, with a focus on Fixed and Variable Rate (FAVR) reimbursement – a sophisticated strategy for 2024 and beyond. You’ll learn:

- The fundamental definition of a car reimbursement program.

- Why FAVR programs are increasingly favored over traditional taxed allowances and company fleets.

- How the expenses of a FAVR program are meticulously calculated.

- The crucial role of mileage tracking in effective car reimbursement.

- Whether outsourcing your car reimbursement program is the right move for your company.

Let’s delve into the details and understand how car reimbursement programs, especially FAVR, can optimize your mobile workforce strategy.

Defining a Car Reimbursement Program: Unpacking FAVR

At its core, a car reimbursement program is a system designed by companies to compensate employees who use their personal vehicles for business purposes. These programs are alternatives to providing company-owned vehicles or issuing simple, often taxable, car allowances. The goal is to fairly and accurately reimburse employees for vehicle expenses incurred while performing their job duties.

FAVR, or Fixed and Variable Rate reimbursement, is a specific type of car reimbursement program sanctioned by the IRS in the United States. It’s a sophisticated method that allows companies to reimburse employees for the business use of their personal vehicles in a tax-free manner. FAVR is essentially a type of car allowance, but structured to comply with IRS regulations, making it a tax-efficient solution.

FAVR stands for “Fixed and Variable Rate” because it comprises two distinct components: a fixed reimbursement and a variable reimbursement. This structure is designed to cover the diverse costs associated with vehicle ownership and operation, ensuring that employees are fully compensated for their work-related driving expenses without incurring unnecessary taxes.

To fully grasp the benefits of FAVR and car reimbursement programs, it’s essential to understand the context they operate within – particularly in comparison to company-owned fleets.

Car Reimbursement Programs vs. Company-Owned Fleets

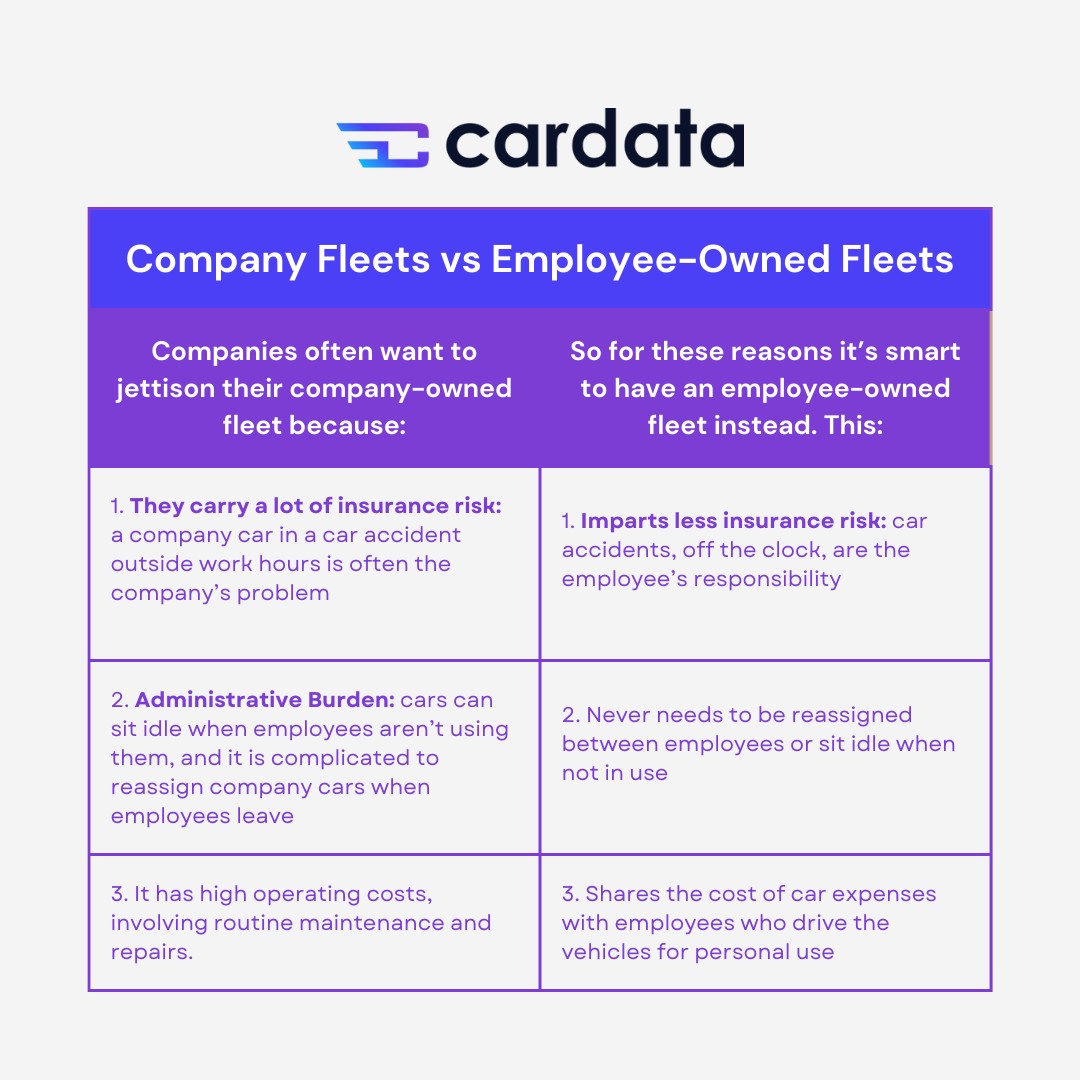

Traditionally, companies often maintained fleets of vehicles for employees to use for business purposes. However, company-owned fleets present several drawbacks that have led many organizations to seek alternatives like car reimbursement programs.

Company-owned fleets are associated with:

- High Insurance Risk: Companies bear significant insurance liability. Accidents involving company cars, even outside of work hours, can become the company’s responsibility.

- Idle Vehicle Costs: Company cars often sit unused when employees are not working, representing a sunk cost. Reassigning vehicles when employees leave or join adds administrative complexity.

- Operational Expenses: Fleets incur substantial operating costs, including routine maintenance, repairs, fuel, and depreciation, all borne directly by the company.

Switching to a car reimbursement program, particularly one based on employee-owned vehicles, offers compelling advantages:

- Reduced Insurance Risk: With employee-owned vehicles, the insurance responsibility for off-the-clock incidents primarily shifts to the employee, significantly reducing the company’s liability.

- Efficient Vehicle Utilization: Vehicles are not idle when not in use for work; employees can utilize their personal cars for personal needs, maximizing vehicle use and eliminating reassignment hassles.

- Shared Cost of Ownership: Car reimbursement programs share vehicle expenses between the company (for business use) and the employee (for personal use), potentially lowering overall costs for the company compared to full fleet ownership.

[Read more about the detailed comparison between fleets and FAVR programs.] (https://www.cardata.co/blog/fleets-company-cars-vs-favr-reimbursement-programs)

Tax Implications: Fleets vs. Car Reimbursement

Expenses associated with company-owned fleets, such as lease payments, fuel, and maintenance, are typically deductible business expenses. Companies do not pay taxes on these expenditures as they are considered necessary investments in business operations. A vehicle fleet is often a crucial tool for many businesses to achieve their objectives.

However, when employees use their personal vehicles for work, managing a tax-free vehicle program in-house becomes more intricate. While companies recognize the benefits of moving away from company fleets, they need a tax-efficient replacement. FAVR reimbursement programs emerge as a leading solution, offering a tax-free alternative. In contrast, simpler options like standard car allowances, if not structured correctly, can be considered taxable income.

Image alt text: Visual representation highlighting that FAVR is a tax-free car allowance program, contrasting with taxable alternatives.

Understanding that FAVR is essentially a tax-advantaged car allowance is a key step in appreciating its benefits.

Car Reimbursement Spectrum: Fleets, FAVR, and Taxable Car Allowances

Companies transitioning away from fleets often consider car allowances. However, a standard car allowance, if not properly substantiated to the IRS, is typically considered taxable income. This means a portion of the allowance (potentially 30-40%) is lost to taxes, reducing its effectiveness and value for both the company and the employee.

Taxable car allowances are subject to payroll taxes and employee income tax. In contrast, a well-structured FAVR program provides a tax-free car allowance. FAVR achieves this tax efficiency through rigorous reporting and data-backed calculations that justify the reimbursement amounts to the IRS, classifying it as a deductible business expense.

A poorly managed car allowance, lacking mileage logs and proper justification, is simply treated as additional income by the IRS and is fully taxable.

For a more detailed understanding of both taxable and tax-free car allowances, you can explore this resource: cardata.co/blog/car-allowance.

Deeper Dive into FAVR: Fixed and Variable Rate Components

As previously mentioned, FAVR stands for “Fixed and Variable Rate.” This name highlights the two core components of this type of car reimbursement program:

- Fixed Reimbursement: This is a set amount paid to employees regularly (typically monthly) to cover the fixed costs of owning and maintaining a vehicle. These costs remain relatively constant regardless of how many miles are driven for business.

- Variable Reimbursement: This component is calculated based on the number of business miles driven by the employee. It’s a per-mile rate designed to cover the variable costs that fluctuate with mileage.

This dual-rate structure allows FAVR to provide a more comprehensive and accurate reimbursement compared to programs that only address fixed or variable costs in isolation.

Is FAVR Complex to Implement?

While the dual-component nature of FAVR makes it more intricate than simpler car allowance or mileage reimbursement programs, the added complexity brings significant benefits in terms of tax savings and fairness. The IRS has detailed guidelines and publications (some exceeding 30 pages) dedicated to FAVR programs, underscoring their structured and rule-based nature. Investing time to understand these guidelines is crucial to maximizing the advantages of FAVR.

The complexity of FAVR stems from the need to accurately calculate and justify both the fixed and variable reimbursement rates. These rates must be based on market research and reflect the actual costs employees incur. This contrasts with simpler programs like cents-per-mile reimbursement, which relies on a standardized rate.

To fully appreciate FAVR, it’s helpful to understand the simpler alternatives – cents-per-mile and flat rate allowances – and their limitations.

Exploring Simpler Reimbursement Methods: Cents per Mile and Flat Rate Allowances

While FAVR combines fixed and variable reimbursements, simpler programs often focus on just one of these aspects. Let’s examine cents per mile and flat rate allowance programs.

Variable Rate Reimbursements: The “Cents per Mile” Approach

The most common form of variable cost-only reimbursement is the Cents Per Mile (CPM) program, often mirroring the IRS standard mileage rate.

CPM programs pay employees a fixed rate for each business mile driven. The IRS sets a standard mileage rate annually (for example, 67 cents per mile in 2024). Companies can reimburse up to this rate tax-free. For instance, if an employee drives 1,000 business miles in a month and the reimbursement rate is the IRS standard rate, they would receive $670 for that month.

The IRS Mileage Rate: Simplicity and Limitations

The IRS mileage rate offers a straightforward variable reimbursement system. As long as companies reimburse at or below the IRS rate and maintain proper mileage logs (including date, destination, business purpose, and odometer readings), the reimbursement is considered tax-free.

This simplicity is attractive, but it also presents limitations. The IRS rate is designed to be a national average, and averages, by their nature, don’t perfectly reflect individual or regional variations in vehicle expenses.

CPM vs. FAVR: Why Variable Rate Alone May Not Be Enough

While CPM is easy to administer, relying solely on a variable rate can be unfair to both companies and employees.

CPM Inefficiencies for Companies

The IRS mileage rate, being an average, can over-reimburse some employees, leading to unnecessary expenses for the company. Vehicle expenses vary significantly based on location, vehicle type, and driving conditions.

For example, consider a high-mileage highway driver in a state with lower fuel costs and favorable driving conditions, like Texas. Fuel prices in Texas are typically lower than in states like California, and highway driving generally results in less wear and tear on a vehicle compared to city driving. Minimal winter conditions also reduce maintenance needs.

Imagine an employee in Houston driving a fuel-efficient Toyota Prius (2019 model) primarily on highways for 40,000 business miles annually. Using the IRS mileage rate, the reimbursement would be substantial.

Image alt text: Table comparing annual reimbursement using IRS mileage rate versus actual vehicle expenses for a high-mileage driver, highlighting over-reimbursement.

At the IRS rate, this driver would receive approximately $25,000 annually. However, the actual cost to operate a 2019 Toyota Prius for 40,000 miles is significantly lower, estimated around $8,746. This means the company is overpaying by a substantial margin – over $16,000 per year for this single driver. This over-reimbursement is not only inefficient but also deviates from the intended purpose of a car reimbursement program – to fairly compensate employees for their actual expenses, not to provide excessive payouts.

CPM Inequities for Employees

Conversely, the IRS rate can also under-reimburse certain employees, particularly low-mileage drivers who still incur fixed vehicle ownership costs. Salespeople or merchandisers who need a car for occasional client visits or store checks, even if their monthly mileage is low, still face significant fixed costs like depreciation, insurance, and registration fees.

Consider an employee who purchased a new car for their job but only drives 100 business miles in a particular month due to business fluctuations. Even with low mileage, they still incur the full burden of fixed car ownership costs, which can be substantial, especially in the early years of ownership. Depreciation alone in the first year can be a significant expense.

Reimbursing only at the IRS cents-per-mile rate for such low mileage would severely undercompensate the employee. For 100 miles at the IRS rate, the reimbursement would be just $67. If fixed costs for that month are around $600, the employee is significantly out-of-pocket, highlighting the inadequacy of a variable-rate-only system for low-mileage drivers with high fixed costs.

Fixed Rate Reimbursements: The Car Allowance Approach

The simplest form of fixed-cost-only reimbursement is a standard car allowance – a fixed monthly payment, for example, $600 per month.

These flat rate car allowances can be taxable or tax-free, depending on whether they are properly justified to the IRS. Justification typically involves demonstrating that the allowance amount is reasonably related to the employee’s anticipated vehicle expenses.

Similar to variable-rate programs, fixed rate allowances also require justification to be considered tax-free. One method for justification is the 463 accountable allowance methodology, sometimes referred to as a Tax-Free Car Allowance program. This approach involves tracking mileage logs and comparing the implied per-mile reimbursement rate (total allowance divided by miles driven) to the IRS mileage rate. If the implied rate is at or below the IRS rate, the allowance can be considered tax-free. However, if the implied rate exceeds the IRS rate, only the excess portion is taxable.

While flat rate allowances offer simplicity, they may not accurately reflect the varying vehicle expenses of employees, especially those with diverse driving patterns. This is where combining fixed and variable rates, as in FAVR programs, becomes advantageous.

FAVR: Combining Fixed and Variable Reimbursements for Accuracy

FAVR programs combine the strengths of both fixed and variable reimbursement approaches. Employees receive a fixed monthly payment to cover ownership costs and a variable per-mile rate to cover operating expenses.

For example, a FAVR program might provide a fixed monthly payment of $300 plus a variable rate of 25 cents per mile. An employee driving 1,000 business miles in a month would receive a total reimbursement of $550 ($300 fixed + $250 variable).

The key to an effective FAVR program is setting the fixed and variable rates based on thorough market research. These rates should reflect the actual costs of vehicle ownership and operation in the geographic areas where employees drive. This “actual costs” approach is a defining characteristic of FAVR and distinguishes it from simpler, less precise reimbursement methods.

Calculating FAVR Rates: A Data-Driven Approach

Calculating accurate FAVR rates requires a detailed understanding of both fixed and variable vehicle expenses. The IRS provides guidelines (Publication 2000-48) outlining the cost categories to consider when designing a FAVR program.

Components of FAVR Calculation: Fixed and Variable Costs

FAVR reimbursement calculations consider the following fixed and variable costs:

Fixed Expenses Reimbursed by FAVR:

- Depreciation or Lease Payments: The decline in vehicle value over time or monthly lease costs.

- Insurance Premiums: Vehicle insurance costs.

- License and Registration Fees: Annual vehicle registration and licensing expenses.

- Personal Property Taxes: Vehicle property taxes (where applicable).

Variable Expenses Reimbursed by FAVR:

- Fuel Prices: Gasoline or electricity costs.

- Oil Changes: Routine oil maintenance.

- Tires: Tire replacement costs.

- Routine Maintenance: Scheduled maintenance services.

- Repairs: Unscheduled vehicle repairs.

(Source: IRS Publication 2000-48)

Accurately quantifying these costs is essential for establishing fair and IRS-compliant FAVR rates. Gathering this data can be complex, which is why many companies choose to outsource their FAVR program administration.

Calculating Variable Costs: Per-Mile Expenses

Variable costs are calculated on a per-mile basis. For example, the cost of an oil change can be converted to a per-mile cost by dividing the cost of an oil change by the mileage interval between changes. Fuel costs are calculated based on local fuel prices and vehicle fuel efficiency. Similarly, tire replacement costs are spread over the expected tire lifespan to determine a per-mile tire expense. Repair and maintenance costs can be estimated based on vehicle type and historical data, and then also converted to a per-mile average.

It’s crucial to recognize that variable costs can vary geographically. Fuel prices, maintenance costs, and repair costs can differ significantly between locations. FAVR programs can account for these regional variations to ensure fair reimbursement for employees in different areas.

Calculating Fixed Costs: Monthly Expenses

Fixed costs are calculated on a monthly basis. Depreciation is typically calculated annually and then divided by 12 to determine a monthly depreciation cost. Insurance premiums, license and registration fees, and personal property taxes are also calculated on a monthly basis. Summing these monthly fixed costs provides the fixed reimbursement component of the FAVR program.

Vehicle Types and Standard Vehicles in FAVR

Many FAVR programs utilize a “standard vehicle” concept. Instead of reimbursing based on the specific car each employee drives, reimbursements are calculated based on a representative vehicle type deemed appropriate for the job.

Companies select standard vehicles for different employee roles. For example, a sales representative might have a standard vehicle like a mid-size sedan, while a field technician might have a standard vehicle like a light truck or SUV. The costs associated with owning and operating the standard vehicle (depreciation, insurance, maintenance, fuel efficiency, etc.) are used to calculate the FAVR rates.

Employees are not required to drive the exact standard vehicle, but their personal vehicle must be comparable in value (typically at least 90% of the new cost of the standard vehicle) to qualify for the FAVR program.

Using standard vehicles simplifies FAVR administration and ensures consistency and fairness across employee reimbursements, as rates are based on objective vehicle cost data rather than individual vehicle choices.

Geographic Considerations: ZIP Codes and Localized FAVR

A key advantage of FAVR is its ability to incorporate geographic variations in vehicle expenses. IRS guidelines explicitly allow for variable rates based on “state schedule for different locales.” This means FAVR programs can be tailored to reflect the specific costs in the regions where employees operate.

For example, a company with employees in both Wyoming and California can design a FAVR program that accounts for the significantly different fuel prices, insurance costs, and maintenance costs in these states. By using localized data, FAVR ensures that reimbursements are fair and accurate for employees in different geographic locations.

Fuel prices are a particularly significant variable cost that can fluctuate widely geographically and over time, making localized fuel cost data crucial for accurate variable rate calculations. Variable expenses, in general, are directly linked to business mileage, reinforcing the need for precise mileage tracking in FAVR programs.

Conclusion: Data Accuracy and Employer Responsibility in FAVR

FAVR programs demand a high degree of accuracy and data diligence from employers. Companies are responsible for conducting thorough market research to justify their chosen FAVR rates. This research must provide data to support the fixed and variable rates, ensuring they are reasonable and reflect actual vehicle expenses.

This data-driven approach is where mileage tracking becomes indispensable. Mileage logs and, increasingly, mileage tracking apps provide the necessary data to administer variable rate reimbursements and to justify the overall FAVR program to the IRS.

[See an example of a traditional mileage logbook.]

Image alt text: Example of a traditional paper-based mileage logbook for recording trip details.

While paper logbooks are still used, digital mileage tracking apps are becoming the standard for their efficiency and accuracy.

Mileage Tracking: The Backbone of Effective Car Reimbursement

Mileage tracking is fundamental to the administration of any robust car reimbursement program, especially FAVR. It provides the data necessary to calculate variable reimbursements and maintain IRS compliance. Beyond simply counting miles, comprehensive mileage tracking captures essential trip details.

A detailed mileage log, whether digital or paper-based, typically records:

- Trip Date

- Trip Destination

- Business Purpose of the Trip

- Starting Odometer Reading

- Ending Odometer Reading

- Total Miles Driven for the Trip

- Extra Expenses Incurred (e.g., tolls)

- Amount of Extra Expenses

Mileage tracking apps automate this process, capturing trip data accurately and efficiently, reducing manual effort and minimizing errors associated with paper logs.

There are two primary categories of mileage trackers:

- Enterprise Mileage Trackers: These are designed for businesses with multiple employees and are often integrated with mileage reimbursement program administration.

- Personal Mileage Trackers: These are typically used by individuals, self-employed workers, or very small businesses for tax record-keeping. Personal trackers are generally not associated with formal FAVR programs.

Examples of Enterprise Mileage Trackers:

- Cardata

- Motus

These solutions are ideal for businesses managing vehicle reimbursement for a mobile workforce.

Examples of Personal Mileage Trackers:

- Everlance

- MileIQ

These apps are well-suited for independent contractors and sole proprietors managing their own business mileage for tax purposes.

Outsourcing Your FAVR Program: Is it the Right Choice?

Given the complexity of FAVR program design, calculation, and administration, many companies, especially SMBs and larger enterprises, find it beneficial to outsource their car reimbursement program to a specialized vendor.

Outsourcing FAVR program management can offer several advantages:

- Expertise and Compliance: Vendors specializing in car reimbursement programs possess in-depth knowledge of IRS regulations and best practices, ensuring program compliance and minimizing tax risks.

- Reduced Administrative Burden: Outsourcing eliminates the need for in-house administration of complex FAVR calculations, mileage tracking management, and reimbursement processing, freeing up internal resources.

- Cost Savings: While there is a cost associated with outsourcing, it can often lead to overall cost savings by optimizing reimbursement rates, preventing overpayments, and avoiding potential tax penalties due to errors in in-house administration.

For companies considering implementing a FAVR program, or those seeking to improve the efficiency and compliance of their existing car reimbursement program, exploring outsourcing options is highly recommended.

If you’re considering outsourcing your FAVR program, Cardata is a leading provider with expertise in designing and managing effective car reimbursement solutions.

[Schedule a discovery call with Cardata today to discuss your car reimbursement needs.] (https://www.cardata.co/demo)

Disclaimer: Please note that this article provides general information about car reimbursement programs and FAVR. It is not legal or accounting advice. Consult with your legal and financial advisors for specific guidance related to your business and circumstances. Do not rely solely on the information in this article for business, financial, or legal decision-making.